United

States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): February 28, 2022

Communications Systems, Inc.

(Exact name of Registrant as Specified in its Charter)

Minnesota

| (State Or Other Jurisdiction Of Incorporation) |

| 001-31588 | 41-0957999 | |

| (Commission File Number) | (I.R.S. Employer Identification No.) |

10900 Red Circle Drive Minnetonka, MN |

55343 | |

| (Address of Principal Executive Offices) | (Zip Code) |

952- 996-1674

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act

| Title of Each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value, $.05 per share | JCS | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Items under Sections 1 through 7 are not applicable and therefore are omitted.

| Item 8.01 | Other Events |

On February 28, 2022, Communications Systems, Inc. (the “Company”) issued a press release attached hereto as Exhibit 99.1 announcing that the Company has provided an investor presentation, attached hereto as Exhibit 99.2, and a question and answer fact sheet, attached hereto as Exhibit 99.3, relating to its proposed merger transaction with Pineapple Energy LLC.

| Item 9.01 | Financial Statements and Exhibits. |

| Exhibit No. | Description

|

| 99.1 | Press release issued by Communications Systems, Inc. on February 28, 2022. |

| 99.2 | Communications Systems, Inc. Investor Presentation dated February 28, 2022. |

| 99.3 | Communications Systems, Inc. Question and Answer Fact Sheet dated February 28, 2022. |

SIGNATUREs

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| COMMUNICATIONS SYSTEMS, INC. | ||

| By: | /s/ Mark D. Fandrich | |

| Mark D. Fandrich, Chief Financial Officer | ||

| Date: February 28, 2022 | ||

2

Communications

Systems Provides Investor Presentation and Q&A

Fact Sheet Detailing Compelling Strategic Rationale and Financial

Benefits of the Proposed Merger with Pineapple Energy

Minnetonka, Minnesota – February 28, 2022 — Communications Systems, Inc. (Nasdaq: JCS) (“CSI” or the “Company”) today provided an investor presentation and questions and answer fact sheet for CSI shareholders detailing the compelling strategic rationale and financial benefits of the proposed merger transaction with Pineapple Energy LLC (“Pineapple”).

Interested investors can access the presentation here and can access the Q&A fact sheet here.

As previously announced, a special meeting of CSI shareholders has been scheduled for Wednesday, March 16, 2022, at 10:00 a.m. Central Time to vote on the proposed Pineapple merger transaction, among other things. Beginning on February 4, 2022, the notice of the special meeting and a proxy statement/prospectus was sent to CSI shareholders as of the January 27, 2022 record date.

The CSI board of directors unanimously recommends that its shareholders vote “FOR” the proposed Pineapple merger transaction.

Following the completion of the proposed merger with Pineapple, CSI will be renamed “Pineapple Holdings, Inc.”, will trade under the new Nasdaq ticker symbol “PEGY,” and will be focused on the rapidly growing home solar, battery storage and energy management industry. Pineapple Holdings will initially operate primarily through its Pineapple, Hawaii Energy Connection and E-Gear subsidiary businesses and intends to pursue additional operating and technology acquisitions throughout 2022.

About Communications Systems, Inc.

Communications Systems, Inc. (Nasdaq: JCS), has operated as an IoT intelligent edge products and services company. For more information regarding CSI, please see www.commsystems.com.

Additional Information and Where to Find It; Participants in the Solicitation

In connection with the proposed merger with Pineapple, Communications Systems, Inc. (“CSI”) filed a registration statement on Form S-4 (File No. 333-260999) with the Securities and Exchange Commission (SEC) on November 12, 2021 (as amended, the “Registration Statement”). The Registration Statement includes a proxy statement/prospectus, and was declared effective by the SEC on February 3, 2022. Beginning February 4, 2022, a copy of the proxy statement/prospectus dated February 3, 2022 was sent to CSI shareholders as of the close of business on January 27, 2022, the record date established for the special meeting.

CSI URGES INVESTORS, SHAREHOLDERS AND OTHER INTERESTED PERSONS TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION.

1

The Registration Statement, preliminary and definitive proxy statement/prospectus, any other relevant documents, and all other documents and reports CSI filed with or furnishes to the SEC are (or, when filed, will be) available free of charge under the "Financial Reports" tab of the Investors Relations section of our website at www.commsystems.com or by directing a request to: Communications Systems, Inc., 10900 Red Circle Drive, Minnetonka, MN 55343. The contents of the CSI website is not deemed to be incorporated by reference into this press release, the Registration Statement or the proxy statement/prospectus. The documents and reports that CSI files with or furnishes to the SEC are (or, when filed, will be) available free of charge through the website maintained by the SEC at http://www.sec.gov.

CSI and its directors and executive officers may be considered participants in the solicitation of proxies by CSI in connection with approval of the proposed merger and other proposals to be presented at the special meeting. Information regarding the names of these persons and their respective interests in the transaction, by securities holdings or otherwise, are set forth in the proxy statement/prospectus dated February 3, 2022. To the extent the Company's directors and executive officers or their holdings of the Company's securities have changed from the amounts disclosed in such filing, to the Company's knowledge, these changes have been reflected on statements of change in ownership on Form 4 on file with the SEC. You may obtain these documents (when they become available, as applicable) free of charge through the sources indicated above.

Forward Looking Statements

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future financial performance, future growth and future acquisitions. These statements are based on Communications Systems’ current expectations or beliefs and are subject to uncertainty and changes in circumstances. There can be no guarantee that the proposed transactions described in this press release will be completed, or that they will be completed as currently proposed, or at any particular time. Actual results may vary materially from those expressed or implied by the statements here due to changes in economic, business, competitive or regulatory factors, and other risks and uncertainties affecting the operation of Communications Systems’ business.

2

These risks, uncertainties and contingencies are presented in the Company’s Annual Report on Form 10-K and, from time to time, in the Company’s other filings with the Securities and Exchange Commission. The information set forth herein should be read considering such risks. Further, investors should keep in mind that the Company’s financial results in any period may not be indicative of future results. Communications Systems is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether because of new information, future events, changes in assumptions or otherwise. In addition to these factors, there are several additional factors, including:

| ● | the conditions to the closing of CSI-Pineapple merger transaction may not be satisfied; | |

| ● | the occurrence of any other risks to consummation of the CSI-Pineapple merger transaction, including the risk that the CSI-Pineapple merger transaction will not be consummated within the expected time period or any event, change or other circumstances that could give rise to the termination of the CSI-Pineapple merger transaction; |

| ● | the CSI-Pineapple merger transaction has involved greater than expected costs and delays and may in the future involve unexpected costs, liabilities or delays; |

| ● | the Company’s ability to sell its other legacy operating business assets and its real estate assets at attractive values; |

| ● | there is no assurance that CSI will receive any of the maximum $7.0 million earnout relating to the August 2, 2021 sale of CSI’s Electronics & Software Segment; |

| ● | the combined company will be entitled to retain ten percent of the net proceeds of CSI legacy assets that are sold pursuant to agreements entered into after the effective date of the merger; |

| ● | risks that the merger will disrupt current CSI plans and operations or that the business or stock price of CSI may suffer as a result of uncertainty surrounding the CSI-Pineapple merger transaction; |

| ● | the outcome of any legal proceedings related to the CSI-Pineapple merger transaction; |

| ● | the fact that CSI cannot yet determine the exact amount and timing of any additional pre-CSI-Pineapple merger cash dividends, if any, or the ultimate value of the Contingent Value Rights that CSI intends to distribute to its shareholders immediately prior to the closing of the CSI-Pineapple merger transaction; and |

| ● | the anticipated benefits of the proposed merger transaction with Pineapple may not be realized in the expected timeframe, or at all. |

Contacts:

For Communications Systems, Inc.

Roger H. D. Lacey

Executive Chair and Interim Chief Executive Officer

+1 (952) 996-1674

Mark D. Fandrich

Chief Financial Officer

+1 (952) 582-6416

mark.fandrich@commsysinc.com

The Equity Group Inc.

Lena Cati

Senior Vice President

+1 (212) 836-9611

lcati@equityny.com

3

+ Merger aims to establish a vertically integrated energy services company through the acquisition of regional solar, storage and energy service businesses nationwide Investor Presentation February 28, 2022

Certain Notices FORWARDLOOKINGSTATEMENTS Inconnectionwiththispresentationandinthispresentation,managementofCommunicationsSystems,Inc.(“CSI’)makescertainforward-lookingstatementswithinthemeaningofthePrivate SecuritiesLitigationReformActof1995.Allstatements,otherthanstatementsofpresentorhistoricalfact,includedinthispresentationregardingtheproposedmergertransactioninvolving PineappleEnergyLLC(“Pineapple”)areforward-lookingstatements. Theseforward-lookingstatementsarebasedonCSImanagement’scurrentexpectationsandassumptionsaboutfuture eventsandarebasedoncurrentlyavailableinformationastotheoutcomeandtimingoffutureevents.Theseforward-lookingstatementsaresubjecttonumerousrisksanduncertainties,including: (i)theconditionstotheclosingofCSI-Pineapplemergertransactionmaynotbesatisfied;(ii)theoccurrenceofanyotherriskstoconsummationoftheCSI-Pineapplemergertransaction,including theriskthattheCSI-Pineapplemergertransactionwillnotbeconsummatedwithintheexpectedtimeperiodoranyevent,changeorothercircumstancesthatcouldgiverisetotheterminationof theCSI-Pineapplemergertransaction;(iii)theCSI-Pineapplemergertransactionhasinvolvedgreaterthanexpectedcostsanddelaysandmayinthefutureinvolveunexpectedcosts,liabilitiesor delays;(iv)theCompany’sabilitytosellitsotherlegacyoperatingbusinessassetsanditsrealestateassetsatattractivevalues;(v)thereisnoassurancethatCSIwillreceiveanyofthemaximum $7.0millionearnoutrelatingtotheAugust2,2021saleofCSI’sElectronics&SoftwareSegment;(vi)thecombinedcompanywillbeentitledtoretaintenpercentofthenetproceedsofCSIlegacy assetsthataresoldpursuanttoagreementsenteredintoaftertheeffectivedateofthemerger;(vii)risksthatthemergerwilldisruptcurrentCSIplansandoperationsorthatthebusinessorstock priceofCSImaysufferasaresultofuncertaintysurroundingtheCSI-Pineapplemergertransaction;(viii)theoutcomeofanylegalproceedingsrelatedtotheCSI-Pineapplemergertransaction; (ix)thefactthatCSIcannotyetdeterminetheexactamountandtimingofanyadditionalpre-CSI-Pineapplemergercashdividends,ifany,ortheultimatevalueoftheContingentValueRightsthat CSIintendstodistributetoitsshareholdersimmediatelypriortotheclosingoftheCSI-Pineapplemergertransaction;and(x)theanticipatedbenefitsoftheproposedmergertransactionwith Pineapplemaynotberealizedintheexpectedtimeframe,oratall.CSIundertakesnoobligationtoupdateorreviseanyforward-lookingstatements,whetherasaresultofnewinformation,future eventsorotherwise,exceptasmayberequiredunderapplicablesecuritieslaws. Certain market datainformationin this presentationis basedon theestimatesof PineappleEnergyand CSI management. PineappleEnergyand CSI obtainedthe industry, marketand competitivepositiondatausedthroughoutthispresentationfrominternalestimatesandresearchaswellasfromindustrypublicationsandresearch,surveysandstudiesconductedbythirdparties. PineappleEnergyandCSIbelievestheirestimatestobeaccurateasofthedateofthispresentation. However,thisinformationmayprovetobeinaccuratebecauseofthemethodbywhich PineappleEnergyorCSIobtainedsomeofthedataforitsestimatesorbecausethisinformationcannotalwaysbeverifiedduetothelimitsontheavailabilityandreliabilityofrawdata,the voluntarynatureofthedatagatheringprocess. TRADEMARKSANDINTELLECTUALPROPERTY Alltrademarks,servicemarks,andtradenamesofPineappleorCSIortheirrespectivesubsidiariesoraffiliatesusedhereinaretrademarks,servicemarks,orregisteredtrademarksofPineapple orCSI,respectively,asnotedherein.Anyotherproduct,companynames,orlogosmentionedhereinarethetrademarksand/orintellectualpropertyoftheirrespectiveowners.

Certain Notices (Cont’d) ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed merger with Pineapple, Communications Systems, Inc. (“CSI”) filed a registration statement onForm S-4 (File No. 333-260999) with the Securities and Exchange Commission (SEC) on November 12, 2021 (as amended, the “Registration Statement”). The Registration Statement includes a proxystatement/prospectus, and was declared effective by the SEC on February 3, 2022. Beginning February 4, 2022, a copy of the proxy statement/prospectus dated February 3, 2022 was sent to CSIshareholders as of the close of business on January 27, 2022, the record date established for the special meeting. CSI URGES INVESTORS, SHAREHOLDERS AND OTHER INTERESTED PERSONS TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. The Registration Statement, preliminary and definitive proxy statement/prospectus, any other relevant documents, and all other documents and reports CSI filed with or furnishes to the SEC are (or, when filed, will be) available free of charge under the "Financial Reports" tab of the Investors Relations section of our website at www.commsystems.com or by directing a request to: Communications Systems, Inc., 10900 Red Circle Drive, Minnetonka, MN 55343. The contents of the CSI website is not deemed to be incorporated by reference into presentation, the Registration Statement or the proxy statement/prospectus. The documents and reports that CSI files with or furnishes to the SEC are (or, whenfiled, will be) available free of charge through the website maintained by the SEC at http://www.sec.gov. PARTICIPANTS IN THE SOLICITATION CSI, Pineapple and their respective directors and executive officers may be considered participants in the solicitation of proxies by CSI in connection with approval of the proposed merger and other proposals to be presented at the CSI special meeting of shareholders. Information regarding the names of these persons andtheir respective interests in the transaction, by securities holdings or otherwise, are set forth in the proxy statement/prospectus dated February 3, 2022. To the extent CSI directors and executive officers or their holdings of CSI securities have changed from the amounts disclosed in such filing, to CSI’s knowledge, these changes have been reflected on statements of change in ownership on Form 4 on file with the SEC. You may obtain these documents (when they become available, as applicable) free of charge through the sources indicated above.

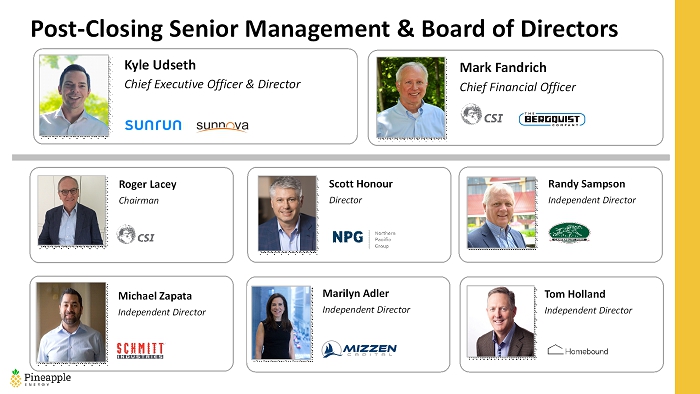

Today’s Presenters Roger Lacey Executive Chairman, CSI Mark Fandrich Chief Financial Officer, CSI Kyle Udseth Founder & CEO, Pineapple

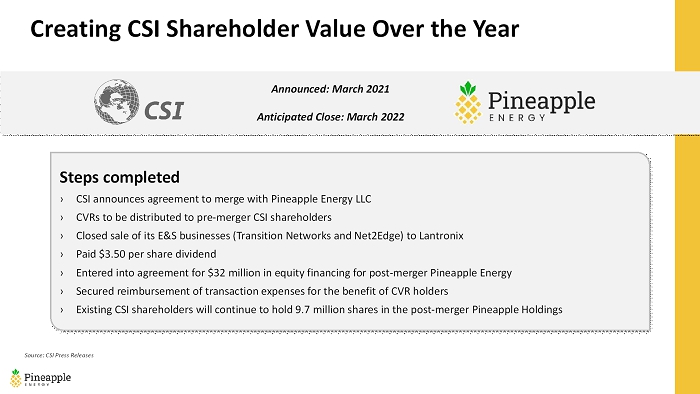

Creating CSI Shareholder Value Over the Year Steps completed › CSI announces agreement to merge with Pineapple Energy LLC › CVRs to be distributed to pre-merger CSI shareholders › Closed sale of its E&S businesses (Transition Networks and Net2Edge) to Lantronix › Paid $3.50 per share dividend › Entered into agreement for $32 million in equity financing for post-merger Pineapple Energy › Secured reimbursement of transaction expenses for the benefit of CVR holders › Existing CSI shareholders will continue to hold 9.7 million shares in the post-merger Pineapple Holdings Announced: March 2021 Anticipated Close: March 2022 Source: CSI Press Releases

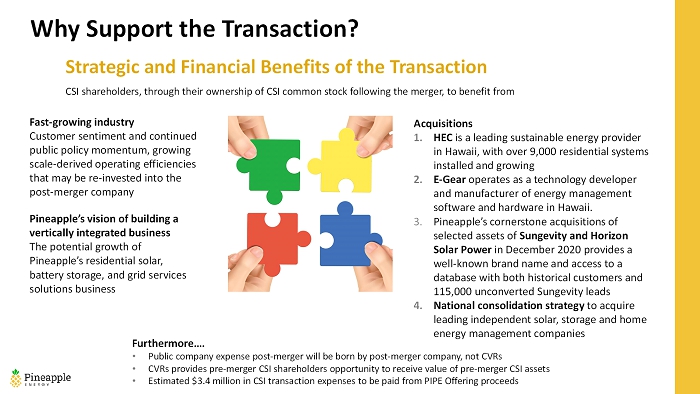

Why Support the Transaction? CSI shareholders, through their ownership of CSI common stock following the merger, to benefit from Strategic and Financial Benefits of the Transaction Fast-growing industry Customer sentiment and continued public policy momentum, growing scale-derived operating efficiencies that may be re-invested into the post-merger company Acquisitions 1. HEC is a leading sustainable energy provider in Hawaii, with over 9,000 residential systems installed and growing 2. E-Gearoperates as a technology developer and manufacturer of energy management software and hardware in Hawaii. 3. Pineapple’s cornerstone acquisitions of selected assets of Sungevity and Horizon Solar Power in December 2020 provides a well-known brand name and access to a database with both historical customers and 115,000 unconverted Sungevity leads 4. National consolidation strategy to acquire leading independent solar, storage and home energy management companies Pineapple’s vision of building a vertically integrated business The potential growth of Pineapple’s residential solar, battery storage, and grid services solutions business Furthermore…. • Public company expense post-merger will be born by post-merger company, not CVRs • CVRs provides pre-merger CSI shareholders opportunity to receive value of pre-merger CSI assets • Estimated $3.4 million in CSI transaction expenses to be paid from PIPE Offering proceeds

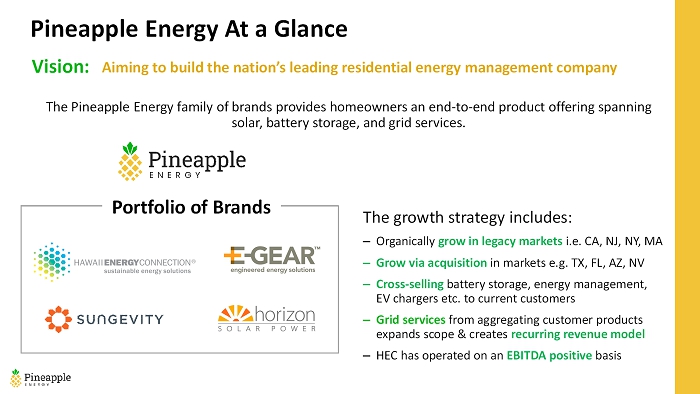

Pineapple Energy At a Glance Aiming to build the nation’s leading residential energy management company Vision: The Pineapple Energy family of brands provides homeowners an end-to-end product offering fontning solar, battery storage, and grid services. Portfolio of Brands The growth strategy includes: –Organically grow in legacy markets i.e. CA, NJ, NY, MA –Grow via acquisition in markets e.g. TX, FL, AZ, NV –Cross-sellingbattery storage, energy management, EV chargers etc. to current customers –Grid servicesfrom aggregating customer products expands scope & creates recurring revenue model –HEC has operated on an EBITDA positive basis

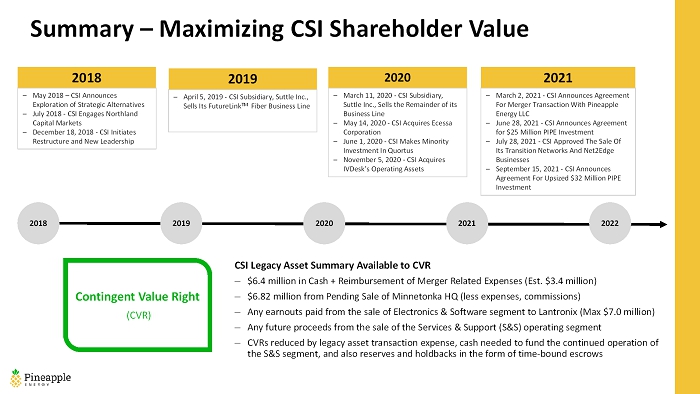

Summary –Maximizing CSI Shareholder Value 2018 2019 2020 2021 2022 – April 5, 2019 -CSI Subsidiary, Suttle Inc., Sells Its FutureLink TM Fiber Business Line 2019 – May 2018 –CSI Announces Exploration of Strategic Alternatives – July 2018 -CSI Engages Northland Capital Markets – December 18, 2018 -CSI Initiates Restructure and New Leadership 2018 – March 11, 2020 -CSI Subsidiary, Suttle Inc., Sells the Remainder of its Business Line – May 14, 2020 -CSI Acquires Ecessa Corporation – June 1, 2020 -CSI Makes Minority Investment In Quortus – November 5, 2020 -CSI Acquires IVDesk’s Operating Assets 2020 – March 2, 2021 -CSI Announces Agreement For Merger Transaction With Pineapple Energy LLC – June 28, 2021 -CSI Announces Agreement for $25 Million PIPE Investment – July 28, 2021 -CSI Approved The Sale Of Its Transition Networks And Net2Edge Businesses – September 15, 2021 -CSI Announces Agreement For Upsized $32 Million PIPE Investment 2021 Contingent Value Right (CVR) CSI Legacy Asset Summary Available to CVR – $6.4 million in Cash + Reimbursement of Merger Related Expenses (Est. $3.4 million) – $6.82 million from Pending Sale of Minnetonka HQ (less expenses, commissions) – Any earnouts paid from the sale of Electronics & Software segment to Lantronix (Max $7.0 million) – Any future proceeds from the sale of the Services & Support (S&S) operating segment – CVRs reduced by legacy asset transaction expense, cash needed to fund the continued operation of the S&S segment, and also reserves and holdbacks in the form of time-bound escrows

Post-Closing Senior Management & Board of Directors Roger Lacey Chairman Kyle Udseth Chief Executive Officer & Director Mark Fandrich Chief Financial Officer Scott Honour Director Randy Sampson Independent Director Michael Zapata Independent Director Marilyn Adler Independent Director Tom Holland Independent Director

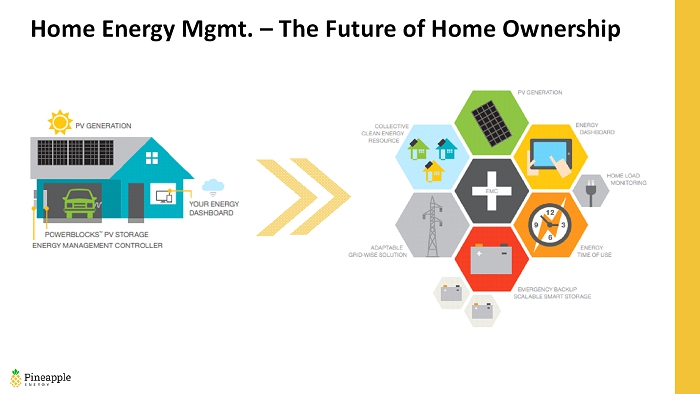

Home Energy Mgmt. –The Future of Home Ownership

Providing Energy Security to Our Customers Acquisition Targets/ Third Party Partners Expertise We providecustomers the best products that fit their unique needs We deliver exceptional customer experiences, leading to referrals and cross-sell opportunities 11 Lead to Sale Technology Grid Services Design Digital, Word-of-mouth and referral leads; flexible sales options to meet customer preference Goal to be leading nationwide vendor for cutting-edge product offerings from Enphase, Generac, and others Become a pioneer in partnering with utilities to monetize grid-edge assets (i.e. batteries, smart-energy controllers) Installation Service Customer management platform ensuring high quality, low risk delivery coupled with best-in- class customer engagement Financing

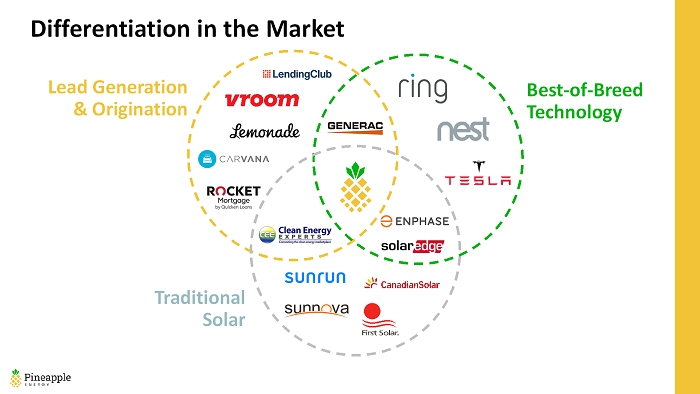

Differentiation in the Market Lead Generation & Origination Traditional Solar Best-of-Breed Technology

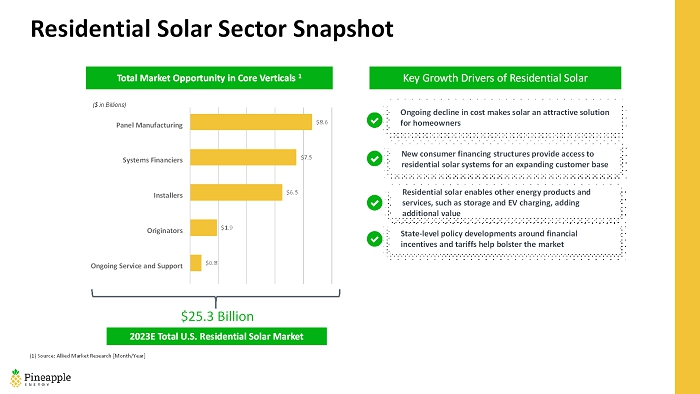

Residential Solar Sector Snapshot Total Market Opportunity in Core Verticals 1 $0.8 $1.9 $6.5 $7.5 $8.6 Ongoing Service and Support Originators Installers Systems Financiers Panel Manufacturing ($ in Billions) Key Growth Drivers of Residential Solar Ongoing decline in cost makes solar an attractive solution for homeowners New consumer financing structures provide access to residential solar systems for an expanding customer base Residential solar enables other energy products and services, such as storage and EV charging, adding additional value State-level policy developments around financial incentives and tariffs help bolster the market 2023E Total U.S. Residential Solar Market $25.3 Billion (1) Source: Allied Market Research [Month/Year]

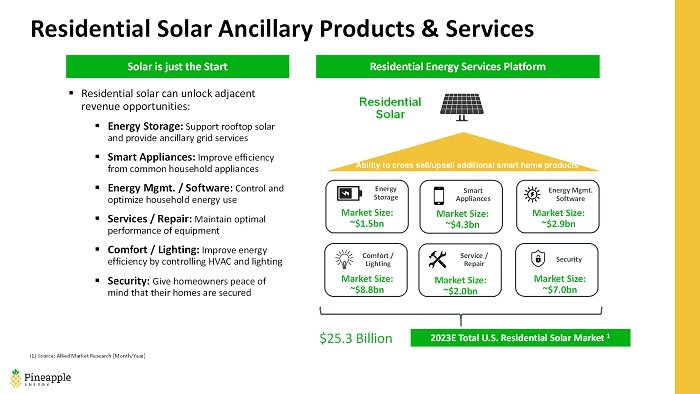

Residential Solar Ancillary Products & Services Solar is just the Start ▪ Residential solar can unlock adjacent revenue opportunities: ▪ Energy Storage: Support rooftop solar and provide ancillary grid services ▪ Smart Appliances: Improve efficiency from common household appliances ▪ Energy Mgmt. / Software: Control and optimize household energy use ▪ Services / Repair: Maintain optimal performance of equipment ▪ Comfort / Lighting: Improve energy efficiency by controlling HVAC and lighting ▪ Security: Give homeowners peace of mind that their homes are secured Residential Energy Services Platform Residential Solar Energy Storage Smart Appliances Energy Mgmt. Software Service / Repair Comfort / Lighting Security Market Size: ~$1.5bn Market Size: ~$2.0bn Market Size: ~$8.8bn Market Size: ~$7.0bn Ability to cross sell/upsell additional smart home products 2023E Total U.S. Residential Solar Market 1 $25.3 Billion Market Size: ~$4.3bn Market Size: ~$2.9bn (1) Source: Allied Market Research [Month/Year]

Contact Info 315 Lake St E Wayzata, MN 55391 Tel: (612) 444-6697 Mark Fandrich Chief Financial Officer Mark.fandrich@commsysinc.com 10900 Red Circle Drive Minnetonka, MN 55343 Tel: (955) 941-2322 Kyle Udseth Chief Executive Officer kyle@pineappleenergy.com Lena Cati Senior Vice President lcati@equityny.com (212) 836-9611 Gary Dvorchak, CFA Managing Director gary@blueshirtgroup.com (323) 240-5796

Communications Systems, Inc.

Question & Answer Fact Sheet

February 28, 2022

This Question & Answer Fact Sheet highlights selected information for shareholders of Communications Systems, Inc. (“CSI” or “we”) regarding the proposed merger transaction involving Pineapple Energy LLC (“Pineapple”). Capitalized terms used in this Question & Answer Fact Sheet and not otherwise defined herein are defined in the proxy statement/prospectus dated February 3, 2022.

Questions Regarding the Pineapple Merger Transaction

Is the Pineapple Merger Transaction supported by the CSI Board of Directors?

The CSI board of directors unanimously recommends that CSI shareholders vote ‘‘FOR’’ the merger proposal and each other proposal to be considered at the special meeting.

Is this a SPAC transaction?

The Pineapple Merger Transaction is not a SPAC transaction. The Pineapple Merger Transaction is a means by which CSI, an operating company, will acquire Pineapple, HEC and E-Gear, which are companies operating in the residential solar industry. Following closing of the Pineapple Merger Transaction, CSI will seek to sell its pre-merger assets with the proceeds, including all cash of CSI as of the effective time of the merger, to be distributed to the pre-merger CSI shareholders through the contingent value rights (“CVRs”).

How much of the combined company will existing CSI shareholders own after the Pineapple Merger Transaction?

CSI has 9,720,627 shares of common stock outstanding. At the effective time of the merger, CSI’s shareholders will continue to own and hold their existing shares of CSI common stock. The Pineapple Merger Transaction will not alter the rights, privileges or nature of the issued and outstanding shares of CSI common stock.

Immediately following the consummation of both the merger and the PIPE Offering, the pre-merger CSI shareholders are expected to own approximately 20.0% of the combined company on a fully-diluted basis; the pre-merger Pineapple unit holders are expected to own approximately 41.2% of the combined company on a fully-diluted basis; and the PIPE Investors are expected to own approximately 38.8% of the combined company on a fully-diluted basis. As part of the fully diluted share ownership, the foregoing calculation (i) includes 15,600,000 shares of CSI common stock that CSI will issue in the merger as Base Consideration, (ii) includes approximately 1,425,000 additional shares of CSI common stock that CSI will issue as Base Consideration in connection with convertible note and debt obligations of Pineapple as part of the Convertible Note Financing, (iii) includes 3,000,000 shares of Earnout Consideration that CSI will issue in the merger relating to the funding-related closing condition, (iv) excludes any additional shares of CSI common stock that are issuable in connection with the merger such as the additional 10,000,000 shares as Earnout Consideration or the Convertible Note Financing other than the convertible note and debt obligations as described above, (v) includes the shares of the combined company common stock that are issuable on conversion of the Series A convertible preferred stock and exercise of warrants issued in the PIPE Offering, and (vi) excludes any shares of combined company common stock issued in connection with awards under the 2022 Equity Incentive Plan shareholders are being asked to approve at the special meeting.

1

Will the combined company remain listed on Nasdaq following the merger?

In order for shares of CSI common stock to continue to be listed on Nasdaq following the closing of the merger, CSI must file and Nasdaq must accept, an initial listing application pursuant to Nasdaq “business combination” rules. CSI is working diligently on this application and, if accepted, shares of CSI common stock would be listed on Nasdaq following the closing of the merger under the trading symbol “PEGY.”

Will CSI’s common stock be delisted from the Nasdaq Stock Market if the Pineapple Merger Proposal is not approved?

The failure of the CSI shareholders to approve the Pineapple Merger Proposal will not, in itself, result in delisting of CSI’s common stock from the Nasdaq Stock Market. However, if CSI fails at any time to comply with all of the requirements for continued listing on the Nasdaq Global Market, the CSI common stock may be delisted.

What are the effects on CSI if the Pineapple Merger Proposal is not approved?

The merger agreement may be terminated by either CSI or Pineapple if the CSI shareholders do not approve the Pineapple Merger Proposal and the Authorized Share Amendment Proposal.

If the merger agreement is terminated for any reason, it is expected that the CSI board of directors will consider the full range of strategic alternatives regarding the use of its remaining cash and other assets, the S&S Segment business, and the future of CSI, with a view to maximizing value for our shareholders under the circumstances. There is no assurance that any of these strategic alternatives will result in dividends or distributions to the CSI shareholders, the return of any particular value to the CSI shareholders, or value that is equal to the value that may be realized by the CSI shareholders through the Pineapple Merger Transaction. Of note, the previously announced $6.8 million (net) sale of the corporate headquarters building requires a 5 year lease with a go-forward operating business to close; it is currently expected that Pineapple will enter into this lease if the merger is completed.

Additionally, many of the transaction expenses relating to the Pineapple Merger Transaction will be payable by CSI regardless of whether the Pineapple Merger Transaction is completed. These fees and expenses are currently estimated at $3.4 million, of which CSI has incurred approximately $2.2 million through December 31, 2021. If the merger agreement is terminated for any reason, CSI will be responsible for its transaction related expenses and none of these expenses will be reimbursed to CSI. In addition, if the merger agreement is terminated for any reason, CSI will continue to incur the costs to operate its S&S Segment business and comply with its public company reporting obligations until the CSI board of directors executes on one or more strategic alternatives.

If the Pineapple Merger Proposal is not approved, what challenges may CSI face in identifying another private company for a similar reverse merger transaction?

If the merger agreement were terminated because the CSI shareholders do not approve the Pineapple Merger Proposal, there is no assurance that CSI would be able to identify any other private company interested in a similar reverse merger transaction or that such a transaction would result in comparable value to the CSI shareholders as the Pineapple Merger Transaction. In particular CSI will face competition from SPACs and other public companies to attract a private company for a similar reverse merger transaction and these SPACs and other public companies may offer cash resources, access to financing or transaction terms that would be more favorable that what CSI could offer. Additionally, CSI’s ability to attract another private company for a similar reverse merger transaction may be hampered by the perception that CSI shareholders would not support a similar reverse merger transaction if the Pineapple Merger Proposal is not approved.

2

Questions Regarding the PIPE Offering

How much will the PIPE Investors invest in the PIPE Offering?

The PIPE Investors will make a $32.0 million private placement investment referred to as the PIPE Offering. Under the terms of the securities purchase agreement, for their $32.0 million investment, the PIPE Investors will receive 32,000 shares of newly authorized CSI Series A convertible preferred stock convertible at a price of $3.40 per share into an aggregate of 9,411,764 shares of CSI common stock, together with five-year warrants to purchase an additional 9,411,764 shares of CSI common stock at an exercise price of $3.40 per share.

What are the conditions to closing the PIPE Offering and when will the PIPE Offering close?

The PIPE Investors are obligated to close the PIPE Offering if certain conditions are met, including approval by CSI shareholders of the PIPE Issuance Proposal and the consummation of the merger. The securities purchase agreement provides that the PIPE Offering will close immediately following the consummation of the merger. The PIPE Investors are obligated to close post-merger regardless of the CSI stock price at that time.

Questions and Answers Regarding the CVRs

Will the Pineapple members or PIPE Investors receive CVRs?

The shareholders of CSI as of the close of the business day immediately preceding the effective time of the merger will receive one contractual non-transferable contingent value right, or CVR, per share of CSI common stock then held by them. Because the distribution of the CVRs occurs prior to the merger, only pre-merger CSI shareholders will receive CVRs and neither the Pineapple members nor PIPE Investors will receive CVRs.

What will happen to CSI’s cash and other legacy assets at the closing of the merger?

At the effective time of the merger, all assets, properties and equipment of CSI, including any cash, will be set aside as CSI legacy assets under the CVR agreement for distribution to the CVR holders through the CVRs. Additionally, CSI legacy assets will be increased by an amount in cash equal to the fees and expenses CSI has paid in connection with the Pineapple Merger Transaction and related transactions before the closing date of the merger. This increase in CSI legacy cash will be funded through a portion of the proceeds of the $32 million PIPE Offering. These fees and expenses are currently estimated at $3.4 million.

Through the CVRs, only the pre-closing CSI shareholders will be entitled to any benefit from the CSI legacy assets. The CSI legacy assets may not be used by the combined company or in the post-closing Pineapple, HEC or E-Gear businesses. Additionally, the combined company or its subsidiaries may not create or permit any encumbrance on any of the CSI legacy assets (including legacy cash and the equity of any CSI subsidiary that was a subsidiary prior to the effective time) until the expiration of the CVR term.

3

How will the combined company fund the operations of Pineapple, HEC and E-Gear following the closing of the merger?

With the CSI legacy cash set aside for the CVR holders, the combined company will fund its post-closing operations initially through a combination of the remaining net proceeds from the PIPE Offering and any cash flow from operations from Pineapple, HEC and E-Gear. Additionally, as Pineapple’s strategy contemplates growth by acquisition. the combined company will need to obtain substantial additional financing arrangements to provide growth capital and potentially for working capital.

* * *

This Question & Answer Fact Sheet does not contain all of the information that is important to you regarding the Pineapple Merger Transaction, the PIPE Offering or other matters presented at the CSI special meeting. To better understand the Pineapple Merger Proposal and the other proposals to be considered at the special meeting, you should read the proxy statement/prospectus dated February 3, 2022 in its entirety carefully, including the appendices.

* * *

Additional Information and Where to Find It

In connection with the proposed merger with Pineapple, Communications Systems, Inc. (“CSI”) filed a registration statement on Form S-4 (File No. 333-260999) with the Securities and Exchange Commission (SEC) on November 12, 2021 (as amended, the “Registration Statement”). The Registration Statement includes a proxy statement/prospectus, and was declared effective by the SEC on February 3, 2022. Beginning February 4, 2022, a copy of the proxy statement/prospectus dated February 3, 2022 was sent to CSI shareholders as of the close of business on January 27, 2022, the record date established for the special meeting.

CSI URGES INVESTORS, SHAREHOLDERS AND OTHER INTERESTED PERSONS TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION.

The Registration Statement, preliminary and definitive proxy statement/prospectus, any other relevant documents, and all other documents and reports CSI filed with or furnishes to the SEC are (or, when filed, will be) available free of charge under the "Financial Reports" tab of the Investors Relations section of our website at www.commsystems.com or by directing a request to: Communications Systems, Inc., 10900 Red Circle Drive, Minnetonka, MN 55343. The contents of the CSI website is not deemed to be incorporated by reference into this document, the Registration Statement or the proxy statement/prospectus. The documents and reports that CSI files with or furnishes to the SEC are (or, when filed, will be) available free of charge through the website maintained by the SEC at http://www.sec.gov.

Participants in the Solicitation

CSI and its directors and executive officers may be considered participants in the solicitation of proxies by CSI in connection with approval of the proposed merger and other proposals to be presented at the special meeting. Information regarding the names of these persons and their respective interests in the transaction, by securities holdings or otherwise, are set forth in the proxy statement/prospectus dated February 3, 2022. To the extent the Company's directors and executive officers or their holdings of the Company's securities have changed from the amounts disclosed in such filing, to the Company's knowledge, these changes have been reflected on statements of change in ownership on Form 4 on file with the SEC. You may obtain these documents (when they become available, as applicable) free of charge through the sources indicated above.

4

Caution Regarding Forward-Looking Statements

This document includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of present or historical fact, included in this document regarding the proposed merger transaction involving Pineapple Energy LLC (“Pineapple”) are forward-looking statements. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements are subject to numerous risks and uncertainties, including: (i) the conditions to the closing of CSI-Pineapple merger transaction may not be satisfied; (ii) the occurrence of any other risks to consummation of the CSI-Pineapple merger transaction, including the risk that the CSI-Pineapple merger transaction will not be consummated within the expected time period or any event, change or other circumstances that could give rise to the termination of the CSI-Pineapple merger transaction; (iii) the CSI-Pineapple merger transaction has involved greater than expected costs and delays and may in the future involve unexpected costs, liabilities or delays; (iv) the Company’s ability to sell its other legacy operating business assets and its real estate assets at attractive values; (v) there is no assurance that CSI will receive any of the maximum $7.0 million earnout relating to the August 2, 2021 sale of CSI’s Electronics & Software Segment; (vi) the combined company will be entitled to retain ten percent of the net proceeds of CSI legacy assets that are sold pursuant to agreements entered into after the effective date of the merger; (vii) risks that the merger will disrupt current CSI plans and operations or that the business or stock price of CSI may suffer as a result of uncertainty surrounding the CSI-Pineapple merger transaction; (viii) the outcome of any legal proceedings related to the CSI-Pineapple merger transaction; (ix) the fact that CSI cannot yet determine the exact amount and timing of any additional pre-CSI-Pineapple merger cash dividends, if any, or the ultimate value of the Contingent Value Rights that CSI intends to distribute to its shareholders immediately prior to the closing of the CSI-Pineapple merger transaction; and (x) the anticipated benefits of the proposed merger transaction with Pineapple may not be realized in the expected timeframe, or at all.

5