UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

Communications Systems, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

COMMUNICATIONS SYSTEMS, INC.

213 South Main Street

Hector, Minnesota 55342

(320) 848-6231

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 20, 2004

Notice is hereby given that the Annual Meeting of Shareholders of Communications Systems, Inc. (the "Company") will be held at the Company's offices located at 6475 City West Parkway, Eden Prairie, Minnesota, on Thursday, May 20, 2004 beginning at 3:00 p.m., Central Daylight Time, for the following purposes:

The Board of Directors has fixed the close of business on March 29, 2004 as the record date for determination of shareholders entitled to notice of and to vote at the meeting.

| By Order of the Board of Directors | ||

Paul N. Hanson, Secretary |

||

Hector, Minnesota April 12, 2004 |

If you expect to attend the Annual Meeting of Shareholders and are not familiar with the

location of the Company's offices in Eden Prairie, Minnesota, we recommend you call

1-800-852-8662 and request that directions be sent to you by mail, email or fax.

TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE SIGN, DATE AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE, WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON. SHAREHOLDERS WHO ATTEND THE MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY SO DESIRE.

COMMUNICATIONS SYSTEMS, INC.

PROXY STATEMENT

| GENERAL INFORMATION | 1 | ||

| Information Regarding the Annual Meeting | 1 | ||

| Solicitation and Revocation of Proxies | 1 | ||

| Voting Securities and Record Date | 1 | ||

CORPORATE GOVERNANCE AND BOARD MATTERS |

2 |

||

| General | 2 | ||

| The Board, Board Committees and Meetings | 2 | ||

| Director Independence | 3 | ||

| Director Nominations | 4 | ||

| Shareholder Nominations | 4 | ||

| Director Compensation | 4 | ||

| Code of Ethics and Business Conduct | 5 | ||

PROPOSAL 1: ELECTION OF DIRECTORS |

6 |

||

PROPOSAL 2: PROPOSAL TO AMEND THE COMPANY'S 1992 STOCK PLAN |

8 |

||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

|||

| Security Ownership Table | 13 | ||

| Section 16(a) Beneficial Ownership Reporting Compliance | 14 | ||

EXECUTIVE COMPENSATION AND OTHER INFORMATION |

15 |

||

COMPENSATION COMMITTEE REPORT |

17 |

||

COMPARATIVE STOCK PERFORMANCE |

20 |

||

THE COMPANY'S AUDITORS |

21 |

||

| Principal Accountant Fees and Services | 21 | ||

| Audit Committee Pre-approval Policies and Procedures | 21 | ||

AUDIT COMMITTEE REPORT |

22 |

||

CERTAIN TRANSACTIONS |

23 |

||

OTHER INFORMATION |

23 |

||

| Contacting the Board of Directors | 23 | ||

| Shareholder Proposals for 2005 Annual Meeting | 23 | ||

| Other Matters; Annual Report | 24 | ||

APPENDIX A—Charter of the Audit Committee of Communications Systems, Inc. |

|||

i

COMMUNICATIONS SYSTEMS, INC.

PROXY STATEMENT

Information Regarding the Annual Meeting

This Proxy Statement is furnished to the shareholders of Communications Systems, Inc. ("CSI" or the "Company") in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Shareholders that will be held at the Company's offices at 6475 City West Parkway, Eden Prairie, Minnesota, on Thursday, May 20, 2004, beginning at 3:00 p.m., Central Daylight Time, or at any adjournment or adjournments thereof. The cost of this solicitation will be paid by the Company. In addition to solicitation by mail, officers, directors and employees of the Company may solicit proxies by telephone, telegraph or in person. The Company may also request banks and brokers to solicit their customers who have a beneficial interest in the Company's Common Stock registered in the names of nominees and will reimburse such banks and brokers for their reasonable out-of-pocket expenses.

Solicitation and Revocation of Proxies

Any proxy may be revoked at any time before it is voted by receipt of a proxy properly signed and dated subsequent to an earlier proxy, or by revocation of a proxy by written request or in person at the Annual Meeting. If not so revoked, the shares represented by such proxy will be voted by the persons designated as proxies in favor of the matters indicated. In the event any other matters that properly come before the meeting require a vote of shareholders, the persons named as proxies will vote in accordance with their judgment on such matters. The Company's corporate offices are located at 213 South Main Street, Hector, Minnesota 55342, and its telephone number is (320) 848-6231. The mailing of this Proxy Statement to shareholders of the Company commenced on or about April 16, 2004.

Voting Securities and Record Date

The total number of shares outstanding and entitled to vote at the meeting as of March 29, 2004 consisted of 8,222,646 shares of $.05 par value Common Stock. Only shareholders of record at the close of business on March 29, 2004 will be entitled to vote at the meeting. Each share of Common Stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. The presence in person or by proxy of the holders of a majority of the shares entitled to vote at the Annual Meeting of Shareholders constitutes a quorum for the transaction of business.

Under Minnesota law, each item of business properly presented at a meeting of shareholders generally must be approved by the affirmative vote of the holders of a majority of the voting power of the shares present, in person or by proxy, and entitled to vote on that item of business. However, if the shares present and entitled to vote on any particular item of business would not constitute a quorum

1

for the transaction of business at the meeting, then that item must be approved by holders of a majority of the minimum number of shares that would constitute such a quorum. Votes cast by proxy or in person at the Annual Meeting of Shareholders will be tabulated at the meeting to determine whether or not a quorum is present. Abstentions on a particular item of business will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining approval of the matter. For shares held in street name, if a broker indicates on the proxy that it does not have discretionary authority as to such shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter, but they are counted as present for the purpose of determining the presence of a quorum.

CORPORATE GOVERNANCE AND BOARD MATTERS

General

Our Board of Directors is committed to sound and effective corporate governance practices. During the past year, we reviewed our governance policies and practices and compared them to those suggested by authorities in corporate governance and the practices of other public companies. We have also continued to review the provisions of the Sarbanes-Oxley Act of 2002, rules of the Securities and Exchange Commission (the "SEC") and revised listing standards of the American Stock Exchange ("AMEX"). As a part of this review process, we have taken steps to implement these rules and other best practices, including:

You can access these materials in the "Investor Relations" section of our website under "Corporate Governance at http://www.commsystems.com/investors/governance.html or by writing to our Corporate Secretary at: Communications Systems, Inc., 213 South Main Street, Hector, Minnesota 55342, or by sending and e-mail to our Corporate Secretary at paulh@commsysinc.com.

The Board, Board Committees and Meetings

Meeting Attendance. Our Board of Directors meets regularly during the year to review matters affecting our Company and to act on matters requiring Board approval. Each of our directors is expected to make a reasonable effort to attend all meetings of the Board, applicable committee meetings and our annual meeting of shareholders. During 2003, the Board of Directors met four times. Each of the directors attended at least 75% of the meetings of the Board and committees on which he or she served, except for Mr. Green who attended 50% meetings of the Board and the committee on which he served. All but one of our directors attended our 2003 Annual Meeting of Shareholders.

2

Board Committees. Our Board of Directors has established the following committees: Audit, Compensation, and Governance and Nominating. Only members of the Board serve on these committees. Following is information about each committee.

Audit Committee. The Audit Committee is responsible for the engagement, retention and replacement of the independent auditors, approval of transactions between the Company and a director or executive officer unrelated to service as a director or officer, approval of non-audit services provided by the Company's independent auditor, oversight of the Company's internal controls and the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters. The Deloitte Entities, the Company's independent public accountants, report directly to the Audit Committee. The Audit Committee operates under a formal charter that was most recently amended as of March 29, 2004, a copy of which is attached to this Proxy Statement as Appendix A. Each of the members of the Audit Committee is independent as defined by SEC and AMEX listing standards. The current members of the Audit Committee are Edwin C. Freeman, Paul J. Anderson and Luella G. Goldberg and the Board of Directors has determined that Edwin C. Freeman qualifies as the Committee's financial expert. The Audit Committee met five times during 2003. The report of the Audit Committee is found on page 22.

Compensation Committee. The Compensation Committee provides oversight of the overall compensation strategy of the Company, reviews and recommends to the Board of Directors the compensation of the Company's Chief Executive Officer and the other executive officers, administers the Company's equity based compensation plans and oversees the Company's 401(k) plan and similar employee benefit plans. The Compensation Committee operates under a charter approved by the Board. Each of the members of the Compensation Committee is independent under AMEX listing standards. The Compensation Committee met four times during 2003. The current members of the Compensation Committee are Gerald D. Pint, Luella G. Goldberg and Frederick M. Green. The report of the Compensation Committee is found on page 17.

Governance and Nominating Committee. The Governance and Nominating Committee was established in 2003 and is responsible for reviewing the size and composition of the Board, identifying individuals qualified to become Board members, recommending to the Board of directors nominees to be elected at the annual meeting of shareholders, reviewing the size and composition of the Board committees, facilitating Board self assessment and reviewing and advising regarding strategic direction and strategic management. The Committee operates under a charter approved by the Board. The current members of the Governance and Nominating Committee are Luella G. Goldberg, Gerald D. Pint and Paul J. Anderson. Each of the members of the Governance and Nominating Committee is independent under AMEX listing standards. The Committee met one time during 2003.

Director Independence

The Board of Directors has adopted director independence guidelines that are consistent with the definitions of "independence" set forth in Section 301 of the Sarbanes-Oxley Act of 2002, Rule 10A-3 under the Securities Exchange Act of 1934 and AMEX listing standards. In accordance with these guidelines, the Board of Directors has reviewed and considered facts and circumstances relevant to the independence of each of our directors and director nominees and has determined that, each of the

3

following directors qualifies as "independent" under AMEX listing standards: Paul J. Anderson, Edwin C. Freeman, Luella G. Goldberg, Frederick M. Green and Gerald D. Pint.

Director Nominations

Our Governance and Nominating Committee is the standing committee responsible for recommending to our full Board of Directors the nominees for election as directors at our annual shareholder meetings. In making its recommendations, the Committee reviews the composition of the full Board to determine the qualifications and areas of expertise needed to further enhance the composition of the Board, and works with management in attracting candidates with those qualifications. In making its recommendations, the Committee considers, among other things, relevant experience, integrity, ability to make independent analytical inquiries, ownership of or commitment to purchase the Company's common stock, understanding of the Company's business, relationships and associations related to the Company's business, personal health and a willingness to devote adequate time and effort to Board responsibilities, all in the context of an assessment of the perceived needs of the Company.

Nominations by Shareholders

Although we have never received a submission in the past, the Governance and Nominating Committee will consider qualified candidates for director that are submitted by our shareholders. Shareholders can submit qualified candidates, together with appropriate biographical information, to the Governance and Nominating Committee at: Communications Systems, Inc., 213 South Main Street, Hector, Minnesota 55432. Submissions will be forwarded to the Chair of the Governance and Nominating Committee for review and consideration. Any stockholder desiring to submit a director candidate for consideration at our 2005 Annual Meeting must ensure that the submission is received by the Company no later than December 1, 2004 in order to provide adequate time for the Company's Governance and Nominating Committee to properly consider the candidate.

Director Compensation

All directors, other than Curtis A. Sampson, receive a monthly retainer of $850, plus $600 for each Board meeting and each committee meeting attended and $300 for each Board or committee meeting in which the director participates by phone. Messrs. Freeman, Wayne E. Sampson and Pint, in consideration for their additional services as members of the Executive Committee, are paid an additional monthly retainer of $250. Curtis A. Sampson received no additional cash compensation for service on the Board.

Presently, each non-employee member of the Board of Directors receives, at the time of the annual meeting of the shareholders, an option to purchase 3,000 shares of the Company's Common Stock. Each director's option is granted at a price equal to the fair market value of the Company's Common Stock on the date of grant and is exercisable over a ten-year period beginning six months after the date the option is granted.

4

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct (the "Code") applicable to all of the Company's officers, directors, employees and consultants that establishes guidelines for professional and ethical conduct in the workplace. The Code also contains a special set of guidelines applicable to the Company's senior financial officers, including the chief executive officer, principal financial officer, principal accounting officer, and others involved in the preparation of the Company's financial reports, that are intended to promote the ethical handling of conflicts of interest, full and fair disclosure in periodic reports filed by the Company and compliance with laws, rules and regulations concerning such periodic reporting. A copy of the Code of Ethics and Business Conduct is available on our website at http://www.commsystems.com/investors/governance.html and is also available, without charge, by writing to the Company's Corporate Secretary at: Communications Systems, Inc., 213 South Main Street, Hector, Minnesota 55342.

5

PROPOSAL 1:

ELECTION OF DIRECTORS

The Board of Directors is presently comprised of eight director positions, divided into three classes, with each class of directors serving staggered three-year terms. The Board of Directors has considered and recommends that the Company's shareholders elect Gerald D. Pint and Curtis A. Sampson, each of whom currently serves as a director, for a three-year term expiring in 2007. The Board of Directors believes that each nominee will be able to serve as a director, however, should a nominee be unable to serve, the persons named in the proxies have advised that they will vote for the election of such substitute nominee as the Governance and Nominating Committee may recommend and the Board of Directors may propose.

Information regarding the nominees and other directors filling unexpired terms is set forth on the following page, including information regarding their principal occupations currently and for the preceding five years. Ownership of Common Stock of the Company is given as of March 29, 2004. To the best of the Company's knowledge, unless otherwise indicated below, the persons indicated possess sole voting and investment power with respect to their stock ownership.

| Name and Age |

Principal Occupation and other Directorships |

Director Since |

Year Current Term Expires |

Amount of Common Stock Ownership |

Percent of Outstanding Common Stock |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Nominees proposed for Election for Terms Expiring in 2007 | |||||||||||

Gerald D. Pint (68) |

Telecommunications consultant since September 1993. Prior thereto, Group Vice President, Telecom Systems Group, 3-M Company, 1989-1993. Director of Hector Communications Corporation (independent telephone companies) and Inventronics Ltd. (telecommunications equipment company). |

1997 |

2004 |

20,000 |

(1) |

* |

|||||

Curtis A. Sampson† (70) |

Chairman of the Board and Chief Executive Officer of the Company; Chairman of the Board of Hector Communications Corporation (independent telephone companies); Chairman of the Board of Canterbury Park Holding Corporation (thoroughbred racing and card club wagering). |

1969 |

2004 |

1,608,285 |

(2) |

19.32 |

% |

||||

Directors Serving Unexpired Terms |

|||||||||||

Paul J. Anderson (72) |

Private Investor |

1975 |

2006 |

181,618 |

(3) |

2.20 |

% |

||||

Frederick M. Green (61) |

Chairman of the Board, President and Chief Executive Officer of Ault Incorporated (power conversion products). |

1996 |

2006 |

21,000 |

(4) |

* |

|||||

Wayne E. Sampson† (74) |

Management consultant; Director of Hector Communications Corporation (independent telephone companies). |

1981 |

2006 |

374,824 |

(5) |

4.54 |

% |

||||

Edwin C. Freeman (48) |

Vice President and General Manager, Bro-Tex, Inc. (paper and cloth wiper products, and fiber product recycler) since March 1992. |

1988 |

2005 |

36,467 |

(6) |

* |

|||||

6

Luella G. Goldberg (67) |

Trustee, University of Minnesota Foundation since 1975; Chair, from 1996 to 1998. Trustee Emerita of Wellesley College since 1996; Trustee, 1978 to 1996; Acting Pres. during 1993; Chair of Board of Trustees, 1985 to 1993. Member, Carlson School Board of Overseers, Univ. of Minnesota, since 1979. Director, TCF Financial Corporation, Hormel Foods Corporation, ING Group and Hector Communications Corporation. |

1997 |

2005 |

23,000 |

(7) |

* |

|||||

Randall D. Sampson† (46) |

Chief Executive Officer of Canterbury Park Holding Corporation (thoroughbred racing and card club wagering). |

1999 |

2005 |

77,824 |

(8) |

* |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE "FOR" EACH OF THE NOMINEES LISTED ABOVE

7

PROPOSAL 2:

PROPOSAL TO AMEND THE COMPANY'S STOCK PLAN

Introduction

The shareholders of the Company approved the Communications Systems, Inc. Stock Plan (the "Stock Plan") on May 15, 1992, originally authorizing 400,000 shares of common stock (as adjusted for a stock split in 1993) for issuance pursuant to options and other rights granted under the Stock Plan. Amendments to increase the number of shares available under the Stock Plan were ratified and approved by the Company's shareholders in 1995, 1998 and 1999. Currently, the maximum number of shares of common stock reserved and available under the Stock Plan for awards is 1,900,000 shares (subject to possible adjustment in the event of stock splits or other similar changes in the common stock). Shares of common stock covered by expired or terminated stock options and forfeited shares of restricted stock or deferred stock may be used for subsequent awards under the Stock Plan. The purpose of the Stock Plan is to enable the Company and subsidiaries to retain and attract key employees who contribute to the Company's success by their ability, ingenuity and industry and to enable such key employees to participate in the long-term success and growth of the Company by giving them a proprietary interest in the Company. On March 29, 2004, the last reported sales price on the Company's common stock on the American Stock Exchange was $8.65.

Amendment to Stock Plan to Increase Authorized Shares

As noted above, the Stock Plan was amended most recently in 1999 to increase the number of authorized shares to 1,900,000. After giving effect to option grants since 1999 to Company employees, including option grants awarded in 2004, only approximately 237,034 shares are available for future option grants, to executives and key employees of the Company's business units, consistent with past practice. Accordingly, in order to continue its practice of awarding stock options to retain, attract and motivate the Company's executives and key employees consistent with past practice, the Board of Directors has again amended the Stock Plan, subject to ratification and approval by the shareholders, to increase the total number of shares available under the Stock Plan by 600,000 shares to a total of 2,500,000.

Summary of the Stock Plan

Eligibility and Administration. Officers and other key employees of the Company and its subsidiaries who are responsible for or contribute to the management, growth and profitability of the business of the Company and its subsidiaries are eligible to be granted awards under the Stock Plan. The Stock Plan is administered by the Board or, in its discretion, by a committee of not less than three "disinterested directors," as defined in the Stock Plan (the "Committee"), who are appointed by the Board of Directors. The term "Board" as used in this section refers to the Board of Directors or, if the Board of Directors has delegated its authority, the Committee. The Board will have the power to make awards, determine the number of shares covered by each award and other terms and conditions of such awards, interpret the Stock Plan, and adopt rules, regulations and procedures with respect to the administration of the Stock Plan. The Board may delegate its authority to officers of the Company for the purpose of selecting key employees who are not officers of the Company to be participants in the Stock Plan.

8

Awards Under Stock Plan. The Stock Plan authorizes the granting of awards in the following forms: (i) stock options, (ii) stock appreciation rights, (iii) restricted stock, and (iv) deferred stock. The Board may grant stock options that either qualify as "incentive stock options" under the Code or are "non-qualified stock options" in such form and upon such terms as the Board may approve from time to time. Stock options granted under the Stock Plan may be exercised during their respective terms as determined by the Board. The purchase price may be paid by tendering cash or, in the Board's discretion, by tendering promissory notes or Company common stock. If the terms of an option so permits, the optionee may elect to pay all or part of the option price by having the Company withhold upon exercise of the option a number of shares with a fair market value equal to the aggregate option exercise price for the shares with respect to which such election is made. No stock option shall be transferable by the optionee or exercised by anyone else during the optionee's lifetime.

Stock options may be exercised during varying periods of time after a participant's termination of employment, dependent upon the reason for the termination. Following a participant's death, the participant's stock options may be exercised to the extent they were exercisable at the time of death by the legal representative of the estate or the optionee's legatee for a period of three years or until the expiration of the stated term of the option, whichever is less. The same time periods apply if the participant is terminated by reason of disability or retirement. If the participant is involuntarily terminated without cause, the participant's options may be exercised to the extent they were exercisable at the time of termination for the lesser of three months or the balance of the options' terms. If the participant's employment is terminated for any other reason, the participant's stock options immediately terminate. Exercise periods may be reduced by the Board for particular options. The Board may, in its discretion, accelerate the exerciseability of stock options that would not otherwise be exercisable upon death, disability or retirement. The term of an incentive stock option may not exceed 10 years (or 5years if issued to a participant who owns or is deemed to own more than 10% of the combined voting power of all classes of stock of the Company, any subsidiary or affiliate). The aggregate fair market value of the common stock with respect to which an incentive stock option is exercisable for the first time by an optionee during any calendar year shall not exceed $100,000.

The exercise price under an incentive stock option may not be less than the fair market value of the common stock on the date the option is granted (or, in the event the participant owns more than 10% of the combined voting power of all classes of stock of the Company, the option price shall be not less than 110% of the fair market value of the stock on the date the option is granted). The exercise price for non-qualified options granted under the Stock Plan may not be less than 50%of the fair market value of the common stock on the date of grant.

The Board may grant stock appreciation rights ("SARs") in connection with all or part of any stock option either at the time of the stock option grant, or, in the case of non-qualified options, later during the term of the stock option. SARs entitle the participant to receive from the Company the same economic value that would have been derived from the exercise of an underlying stock option and the immediate sale of the shares of common stock. Such value is paid by the Company in cash, shares of common stock or a combination of both, in the discretion of the Board. SARS are exercisable or transferable only at such times and to the extent stock options to which they relate are exercisable or transferable. If a SAR is exercised, the underlying stock option is terminated as to the number of shares covered by the SAR exercise.

9

The Board may grant restricted stock awards that result in shares of common stock being issued to a participant subject to restrictions against disposition during a restricted period established by the Board. The Board may condition the grant of restricted stock upon the attainment of specified performance goals or service requirements. The provisions of restricted stock awards need not be the same with respect to each recipient. The restricted stock will be held in custody by the Company until the restrictions thereon have lapsed. During the period of the restrictions, a participant has the right to vote the shares of restricted stock and to receive dividends and distributions unless the Board requires such dividends and distributions to be held by the Company subject to the same restrictions as the restricted stock. Notwithstanding the foregoing, all restrictions with respect to restricted stock lapse 60 days (or less as determined by the Board) prior to the occurrence of a merger or other significant corporate change, as provided in the Stock Plan. If a participant terminates employment during the period of the restriction, all shares still subject to restrictions will be forfeited and returned to the Company, subject to the right of the Board to waive such restrictions in the event of a participant's death, total disability, retirement or under special circumstances approved by the Board.

The Board may grant deferred stock awards that result in shares of common stock being issued to a participant or group of participants upon the expiration of a deferral period. The Board may condition the grant of deferred stock upon the attainment of specified performance goals. The provisions of deferred stock awards need not be the same with respect to each recipient. Upon termination of employment for any reason during the deferral period for a given award, the deferred stock in question shall be forfeited by the participant, subject to the Board's ability to waive any remaining defer all limitations with respect to a participant's deferred stock. During the deferral period, deferred stock awards may not be sold, assigned, transferred, pledged or otherwise encumbered and any dividends declared with respect to the number of shares covered by a deferred stock award will either be immediately paid to the participant or deferred and deemed to be reinvested in additional deferred stock, as determined by the Board. The Board may allow a participant to elect to further defer receipt of a deferred stock award for a specified period or until a specified event.

The Board may, at the time of any grant under the Stock Plan, provide that the shares received by any participant under the Stock Plan shall be subject to repurchase by the Company in the event of termination of employment of the participant for any reason. Except as provided otherwise by the Board, the repurchase price will be the fair market value of the stock or, in the case of a termination for cause (as defined in the Stock Plan), the amount of consideration paid for the stock. The Board may also, at the time of grant, provide the Company with rights to repurchase, or require the forfeiture of, shares of stock acquired under the Stock Plan by any participant who, at anytime within two years after termination of employment with the Company, directly or indirectly competes with, or is employed by a competitor of, the Company.

Federal Income Tax Consequences

Stock Options. An optionee will not realize taxable compensation income upon the grant of an incentive stock option. In addition, an optionee generally will not realize taxable compensation income upon the exercise of an incentive stock option if he or she exercises it as an employee or within three months after termination of employment (or within one year after termination if the termination results from a permanent and total disability). The amount by which the fair market value of the shares purchased exceeds the aggregate option price at the time of exercise (or, in the case of an executive

10

officer, director or 10% shareholder, six months after the date the option as granted, if later) will be treated as alternative minimum taxable income for purposes of the alternative minimum tax. If stock acquired pursuant to an incentive stock option is not disposed of prior to the date two years from the option grant date or prior to one year from the option exercise date, any gain or loss realized upon the sale of such shares will be characterized as capital gain or loss. If the applicable holding periods are not satisfied, then any gain realized in connection with the disposition of such stock will generally be taxable as compensation income in the year in which the disposition occurred, to the extent of the difference between the fair market value of such stock on the date of exercise and the option exercise price. The Company is entitled to a tax deduction to the extent, and at the time, that the participant realizes compensation income. The balance of any gain will be characterized as a long-tem or short-tem capital gain, depending on whether the shares were held for more than one year. An optionee will not realize taxable compensation income upon the grant of a non-qualified stock option. When an optionee exercises a non-qualified stock option, he or she will realize taxable compensation income at that time equal to the difference between the aggregate option price and the fair market value of the stock on the date of exercise. If, however, an optionee is subject to Section 16(b) of the Securities Exchange Act of 1934 (i.e., is an executive officer, director or 10% shareholder of the Company) and the optionee exercises the option within six months after the date the option was granted, he or she will not realize taxable compensation income until six months after the grant of the non-qualified stock option (subject to the right of the optionee to elect to be taxed at the time of exercise). In the event realization of the income is deferred, the amount of the optionee's compensation income will be equal to the difference between the aggregate option price and the fair market value of the stock on the date immediately preceding the sixth month anniversary of the date of grant. The Company is entitled to a tax deduction to the extent and at the time, that the participant realizes compensation income. Upon the disposal of stock acquired pursuant to a non-qualified option, the optionee's basis for determining taxable gain or loss will be the sum of the option price paid for the stock plus my any related compensation income recognized by the optionee, and such gain or loss will be long-term or short-term capital gain or loss depending on whether the optionee has held the shares for more than one year.

SARs. The grant of a SAR would not result in income for the participant or in a deduction for the Company. Upon receipt of shares or cash from the exercise of a SAR, the participant would generally recognize compensation income, and the Company would be entitled to a deduction, measured by the fair market value of the shares plus any cash received.

Restricted Stock And Deferred Stock. The grant of restricted stock and deferred stock should not result in immediate income for the participant or in a deduction for the Company for federal income tax purposes, assuming the shares are nontransferable and subject to restrictions or to a deferral period that would result in a "substantial risk of forfeiture" as intended by the Company. If the shares are transferable or there are no such restrictions or significant deferral period, the participant will realize compensation income upon receipt of the award. Otherwise, a participant will generally realize compensation income upon any such restrictions or deferral period lapses. The amount of such income will be the value of the common stock on that date less any amount paid for the shares. Dividends paid on the common stock and received by the participant during the restricted period or deferral period would also be taxable compensation income to the participant. In any event, the Company will be entitled to a tax deduction to the extent, and at the time, that the participant realizes compensation income. A participant may elect, under Section 83(b) of the Code, to be taxed on the value of the

11

stock at the time of award. If this election is made, the fair market value of the stock at the time of the award is taxable to the participant as compensation income and the Company is entitled to a corresponding deduction.

Withholding. The Stock Plan requires each participant, no later than the date as of which any part of the value of an award first becomes includible as compensation in the gross income of the participant, to pay to the Company any federal, state or local taxes required by law to be withheld with respect to the award. The Company shall, to the extent permitted by law, have the right to deduct any such taxes from any payment otherwise due to the participant. With respect to any award under the Stock Plan, if the terms of the award so permit, a participant may elect to satisfy part or all of the withholding tax requirements associated with the award by (i) authorizing the Company to retain from the number of shares of stock which would otherwise be deliverable to the participant, or (ii) delivering to the Company from shares of Company common stock already owned by the participant, that number of shares having an aggregate fair market value equal to part or all of the tax payable by the participant. In this event, the Company would pay the tax liability from its own funds.

Registration With SEC

If the shareholders approved the proposed amendment to increase the Plan's authorized shares, the Company intends to file a registration statement covering the issuance of the additional shares issuable under the Stock Plan, as amended, with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended.

Shareholder Approval

The affirmative vote of a majority of the outstanding shares of the Company's common stock present at the annual meeting in person or by proxy is required for approval of the proposed amendment to the Company's Stock Plan, except in circumstances described under "General Information—Voting Securities and Record Date."

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" APPROVAL

OF THE AMENDMENT OF THE STOCK PLAN TO INCREASE THE NUMBER OF

SHARES AUTHORIZED FOR ISSUANCE UNDER THE STOCK PLAN TO 2,500,000

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership Table

The following table sets forth the number of shares of the Company's Common Stock owned by each person known by the Company to own of record or beneficially five percent (5%) or more of the Company's Common Stock, and all officers and directors of the Company as a group using, information available as of March 29, 2004.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of Class |

|||

|---|---|---|---|---|---|

| Curtis A. Sampson 213 South Main Street Hector, MN 55342 |

1,608,285 | (1) | 19.32 | % | |

| FMR Corp. 82 Devonshire Street Boston, MA 02109 |

818,281 | (5) | 9.95 | % | |

| Gabelli Asset Management Inc. One Corporate Center Rye, NY 10580-1435 |

547,000 | (2) | 6.65 | % | |

| John C. Ortman 1506 17th Street Lawrenceville, IL 62439 |

543,350 | 6.61 | % | ||

| Putnam, LLC One Post Office Square Boston, MA 02109 |

497,856 | (4) | 6.05 | % | |

| Paul N. Hanson 213 South Main Street Hector, MN 55342 |

490,968 | (3) | 5.93 | % | |

| Dimensional Fund Advisors Inc. 1299 Ocean Avenue Santa Monica, CA 90401 |

330,300 | (6) | 4.02 | % | |

| All directors and executive officers as a group (17 persons) | 2,601,952 | (7) | 29.44 | % |

13

a Trustee. Mr. Hanson disclaims any beneficial ownership of shares owned by the CSI ESOP and the Hector ESOP in excess of the 11,163 shares allocated to his accounts on December 31, 2003.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company's officers, directors and beneficial holders of 10% or more of the Company's securities are required to file reports of their beneficial ownership with the Securities and Exchange Commission on SEC Forms 3, 4 and 5. According to the Company's records, all other reports required to be filed during this period pursuant to Section 16(a) were timely filed, except as follows: a Form 4 was not timely filed by Messrs. Berg, Braun, Hanson, Lucker, McGraw and Skucius, to report a purchase of common stock in October 2003 under the Company's Stock Purchase Plan; a Form 4 was not timely filed by Messrs. Braun, C. Sampson, Easter, Hanson, Lapping, Lucker, McGraw and Skucius to report stock options granted in March 2003 pursuant to the Company's Employee Stock Option Plan; and a Form 4 was not timely filed by Messrs. Anderson, Freeman, Green, Pint, R. Sampson and W. Sampson and Ms. Goldberg to report stock options granted in May 2003 pursuant to the Company's Stock Option Plan for Non-employee Directors. These officers and directors have subsequently reported all of the transactions described above on a Form 4 or 5 filed with the SEC.

14

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash and Certain Other Compensation

The following tables show, for the fiscal years ending December 31, 2003, 2002 and 2001, the cash and other compensation paid to, or accrued for, Curtis A. Sampson, our Chief Executive Officer, and the four next most highly compensated executive officers of the Company, as of December 31, 2003, in all capacities served, as well as information relating to option grants, option exercises and fiscal year end option values applicable to such persons.

Summary Compensation Table

| |

|

|

|

Long-Term Compensation Awards |

|

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Annual Compensation |

|

|||||||||||

| Name and Principal Position |

Securities Underlying Options(1) |

All Other Compensation(2) |

|||||||||||

| Year |

Salary |

Bonus(1) |

|||||||||||

| Curtis A. Sampson, Chief Executive Officer(3) |

2003 2002 2001 |

$ $ $ |

195,194 182,000 197,077 |

$ $ $ |

17,549 38,400 0 |

18,000 18,000 15,000 |

$ $ $ |

4,500 4,492 3,999 |

|||||

| Jeffrey K. Berg, President and Chief Operating Officer(4) |

2003 2002 2001 |

$ $ $ |

219,615 194,715 175,000 |

$ $ $ |

17,549 48,400 0 |

15,000 15,000 12,000 |

$ $ $ |

10,500 9,992 9,249 |

|||||

| Thomas J. Lapping, President and General Manager JDL Technologies, Inc. |

2003 2002 2001 |

$ $ $ |

130,385 120,000 119,580 |

$ $ $ |

76,214 150,175 10,000 |

7,200 6,900 6,720 |

$ $ $ |

9,652 9,225 7,259 |

|||||

| Daniel G. Easter, President and General Manager Transition Networks, Inc. |

2003 2002 2001 |

$ $ $ |

177,322 175,000 176,725 |

$ $ $ |

100,037 108,835 61,740 |

9,000 12,000 12,000 |

$ $ $ |

4,500 6,014 8,549 |

|||||

| David T. McGraw President and General Manager Suttle Apparatus(5) |

2003 2002 2001 |

$ $ $ |

128,471 97,500 44,000 |

$ $ $ |

45,067 85,084 4,375 |

7,800 3,900 0 |

$ $ $ |

9,732 5,951 0 |

|||||

15

Option Grants In 2003

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Individual Grants |

||||||||||||||

| |

Number of Securities Underlying Options Granted |

% of Total Options Granted to Employees in 2003 |

|

|

|||||||||||

| Name |

Exercise Price Per Share |

Expiration Date |

|||||||||||||

| 5% |

10% |

||||||||||||||

| Curtis A. Sampson | 18,000 | 7.2 | % | $ | 7.854 | 3/7/08 | $ | 22,656 | $ | 65,611 | |||||

| Jeffrey K. Berg | 15,000 | 6.0 | % | $ | 7.14 | 3/7/08 | $ | 29,590 | $ | 65,386 | |||||

| Thomas J. Lapping | 7,200 | 2.9 | % | $ | 7.14 | 3/7/08 | $ | 14,203 | $ | 31,385 | |||||

| Daniel G. Easter | 9,000 | 3.6 | % | $ | 7.14 | 3/7/08 | $ | 17,754 | $ | 39,231 | |||||

| David T. McGraw | 7,800 | 3.1 | % | $ | 7.14 | 3/7/08 | $ | 15,387 | $ | 34,001 | |||||

Aggregated Option Exercises

In 2003 and Year-End Option Values

| |

|

|

|

|

Value of Unexercised In the Money Options at FY End (Based on 12/31/03 Price of $8.01 /Share) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

Number of Unexercised Options at 12/31/03 |

||||||||||||

| |

|

Value Realized (Market Price at exercise less exercise price) |

|||||||||||||

| Name |

Shares Acquired on Exercise |

||||||||||||||

| Exercisable |

Nonexercisable |

Exercisable |

Nonexercisable |

||||||||||||

| Curtis A. Sampson | -0- | $ | 0 | 72,000 | 18,000 | $ | 936 | $ | 1,872 | ||||||

| Jeffrey K. Berg | -0- | $ | 0 | 57,000 | 15,000 | $ | 4,350 | $ | 8,700 | ||||||

| Thomas J. Lapping | -0- | $ | 0 | 33,325 | 7,100 | $ | 2,088 | $ | 4,176 | ||||||

| Daniel G. Easter | -0- | $ | 0 | 80,775 | 10,000 | $ | 2,610 | $ | 5,220 | ||||||

| David T. McGraw | 2,600 | $ | 1,976 | 5,600 | 6,500 | $ | 0 | $ | 4,524 | ||||||

16

Equity Compensation Plan Information

The following table sets forth certain information as of December 31, 2003, regarding securities authorized for issuance under the Company's equity compensation plans.

Securities Authorized for Issuance Under Equity Compensation Plans

| |

(a) |

(b) |

(c) |

|||||

|---|---|---|---|---|---|---|---|---|

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||

| Equity compensation plans approved by security holders: | ||||||||

| 1992 Stock Plan | 1,158,956 | $ | 10.54 | 285,423 | ||||

| 1990 Employee Stock Purchase Plan | 25,865 | $ | 6.88 | 78,467 | ||||

| Equity compensation plans not approved by security holders(1) | None | |||||||

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

Our executive compensation programs are administered by the Compensation Committee of the Board of Directors. The Committee is currently composed of independent, non-employee directors, none of whom was at any time during the past fiscal year an officer or employee of the Company, was formerly an officer of the Company or any of its subsidiaries, or had any employment relationship with the Company. Mr. Sampson, the Company's Chairman and Chief Executive Officer, participated in the deliberations of the Compensation Committee that occurred during fiscal 2003 regarding executive compensation, but did not take part in deliberations regarding his own compensation. Mr. Sampson's participation in the deliberations of the Compensation Committee included providing information on the performance of people who work at the Company and advisory recommendations regarding the appropriate levels of compensation for the Company's officers.

The Compensation Committee appointed by the Company's Board of Directors has primary responsibility in regard to determinations relating to executive compensation and administration of the Company's stock option plans. All decisions by the Compensation Committee pertaining to the compensation of the Company's executive officers are reviewed and approved by the full Board.

Compensation Policies

It is the objective of the Compensation Committee to pay compensation at levels that will attract, retain and motivate executives with superior leadership and management abilities and to structure the

17

forms of compensation paid in order that their interests will be closely aligned with Company's in achieving superior financial performance. With these objectives in mind, the compensation currently paid to the Company's executive officers principally consists of three elements: base salary, bonus and periodic stock option awards.

Compensation Elements

Base salaries of the Company's executive officers are generally established by reference to base salaries paid to executives in similar positions with similar responsibilities based upon publicly available compensation surveys and limited informal surveys by Compensation Committee members. Base salaries are reviewed annually and adjustments are usually made during the first quarter of a fiscal year based primarily on individual and Company performance during the immediately preceding fiscal year. Consideration is given by the Compensation Committee to both measurable financial factors, as well as subjective judgments regarding factors such as development and execution of strategic plans, changes in areas of responsibility and the development and management of employees. The Compensation Committee does not, however, assign specific weights to these various quantitative and qualitative factors in reaching its decisions. Adjustments in base compensation for four of the executives named above averaged 7.5% and reflected consideration of fiscal 2002 results compared to fiscal 2001 results in which the Company's revenues and net income increased approximately 13% and 300%, respectively. A fifth executive received a 31.7% adjustment in base compensation due to a promotion in October 2002 involving substantially greater responsibilities.

Bonuses are intended to provide executives with an opportunity to receive additional cash compensation, but only if they earn it through Company and individual performance. In 2003, the Compensation Committee used a bonus compensation system based almost exclusively on financial targets established at the beginning of fiscal year 2003. The total amount of bonuses paid to the executive officers of the Company named in the table above for 2003 was $256,416 compared to total bonuses paid in fiscal 2002 of $430,894 to such executive officers. By way of comparison, the Company posted a 4% decline in revenues and a 16% increase in earnings in 2003 compared to 2002.

The Committee regards cash compensation paid to the Company's executive officers as reasonable in relation to published information regarding compensation of executives with similar responsibilities and the Company's financial performance.

Stock options are awarded to the Company's executives under the Company's 1992 Stock Plan. Stock options represent an additional vehicle for aligning management's and stockholders' interests, specifically motivating executives to remain focused on factors that will enhance the market value of the Company's common stock. If there is no price appreciation in the common stock, the option holders receive no benefit from the stock options, because options are granted with an option exercise price at least equal to the fair market value of the common stock on the date of grant. During the first quarter of fiscal 2003, the Committee granted stock options to purchase 57,000 shares of common stock to the five named executive officers, which represented approximately 22.8% of the total options granted to all officers and key employees.

18

Chief Executive Officer Compensation

Mr. Curtis A. Sampson, the Company's Chief Executive Officer, participates in the same executive compensation plans provided to other senior executives and is evaluated by the same factors applicable to the other executives as described above. Mr. Sampson's base compensation was increased 7.2% at the beginning of 2003, reflecting the improved results in 2002 compared to 2001 discussed above. For 2003, Mr. Sampson received a bonus of $17,549, compared to a bonus of $38,400 for 2002, under the same bonus program applicable to other executive officers. As a result, Mr. Sampson's total cash compensation with respect to 2003 was $212,743, a decrease of 3.6% over total cash compensation in 2002. Mr. Sampson devotes approximately 50% of his working time to the Company and 50% to Hector Communications Corporation, where he also serves as Chief Executive Officer. In 2003 Mr. Sampson was awarded options to acquire 18,000 shares of common stock. Because of his significant holdings of Company common stock, under applicable IRS rules, Mr. Sampson's options are priced at 110% of the market price on the date of grant. The Compensation Committee believes, based upon their general knowledge of compensation paid to other chief executives and a review of published regional salary data (but without conducting a formal survey), that Mr. Sampson's total compensation as an executive officer of the Company is reasonable in relation to the scope of his responsibilities and financial performance of the Company during the past several years.

Submitted by the Compensation Committee of the Board of Directors

Luella Gross Goldberg Frederick M. Green Gerald D. Pint

19

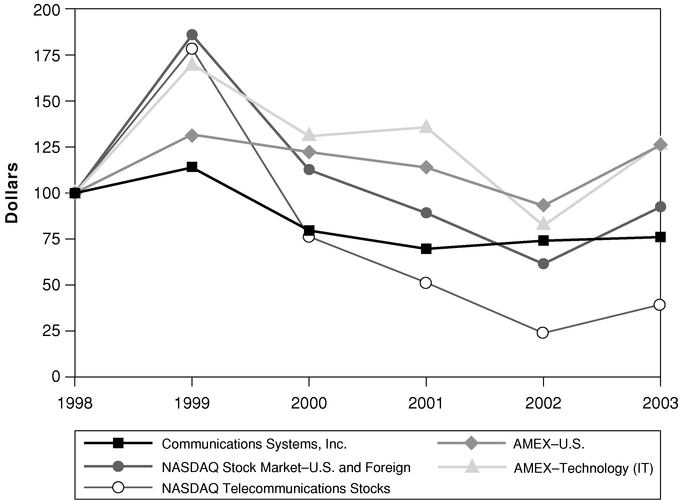

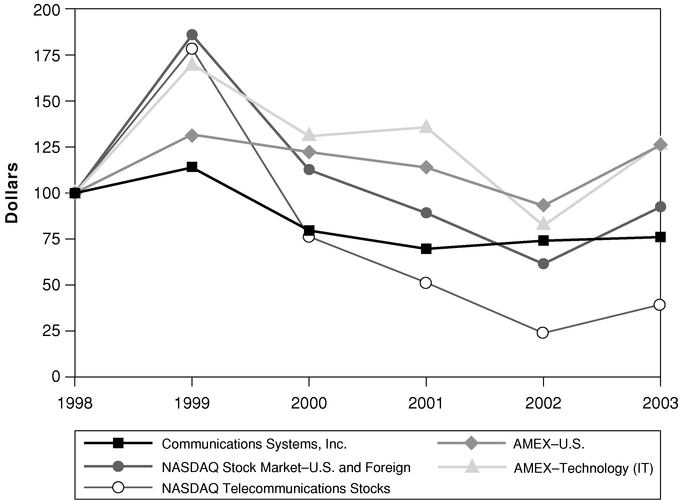

The following graph presents, at the end of each of the Company's last five fiscal years, the cumulative total return on the common stock of the Company as compared to the cumulative total return reported for the NASDAQ Stock Market Total Return Index (U.S. and Foreign Companies) and the NASDAQ Telecommunications Stocks Total Return Index, two indices the Company has used in proxy statements prior to this year, as well as the cumulative total return reported for the AMEX Total Return Index (U.S.) and the AMEX Technology (IT) Total Return Index, two indices the Company has determined to use beginning this year because it is now an AMEX list company. Company information and each index assumes the investment of $100 on the last business day before January 1, 1999 and the reinvestment of all dividends.

Comparison of Five-Year Cumulative Total Return

| |

Total Return at December 31 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company or Index |

||||||||||||

| 1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

|||||||

| Communications Systems, Inc. | 100 | 113.917 | 79.387 | 69.550 | 73.902 | 75.874 | ||||||

| NASDAQ Stock Market—U.S. and Foreign | 100 | 186.437 | 112.657 | 88.893 | 61.168 | 92.264 | ||||||

| NASDAQ Telecommunications Stocks | 100 | 178.714 | 76.111 | 50.975 | 23.472 | 39.023 | ||||||

| AMEX—U.S. | 100 | 131.942 | 122.379 | 113.911 | 93.104 | 126.027 | ||||||

| AMEX Technology (IT) | 100 | 170.250 | 131.028 | 135.880 | 82.036 | 126.712 | ||||||

20

Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, the "Deloitte Entities") have been the auditors for the Company since 1982 and have been selected by the Board of Directors, upon recommendation of the Audit Committee, to serve as such for the current fiscal year. A representative of the Deloitte Entities is expected to be present at the Annual Meeting of Shareholders and will have an opportunity to make a statement and will be available to respond to appropriate questions.

Principal Accountant Fees and Services

The following is a summary of the fees billed to the Company by the Deloitte Entities for professional services rendered for the fiscal years ended December 31, 2003, and December 31, 2002. The Audit Committee considered and discussed with the Deloitte Entities the provision of non-audit services to the Company and the compatibility of providing such services with maintaining its independence as the Company's auditor.

| Fee Category |

2003 |

2002 |

|||||

|---|---|---|---|---|---|---|---|

| Audit Fees | $ | 240,369 | $ | 193,425 | |||

| Audit-Related Fees | 14,715 | 14,200 | |||||

| Tax Fees | 102,080 | 71,290 | |||||

| All Other Fees | 0 | 0 | |||||

| Total Fees | $ | 357,164 | $ | 279,515 | |||

Audit Fees. This category consists of fees billed for professional services rendered for the audit of our annual financial statements and review of financial statements included in our quarterly reports.

Audit-Related Fees. This category consists of fees billed for assurance and related services, such as our employee benefit plan audits, that are reasonably related to the performance of the audit or review of our financial statements and are not otherwise reported under "Audit Fees."

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance and acquisitions.

Audit Committee Pre-approval Policies and Procedures

In addition to approving the engagement of the independent auditor to audit the Company's consolidated financial statements, it is the policy of the Committee to approve all use of the Company's independent auditor for non-audit services prior to any such engagement. To minimize relationships that could appear to impair the objectivity of the independent auditor, it is the policy of the Committee to restrict the non-audit services that may be provided to the Company by the Company's independent auditor primarily to tax services and merger and acquisition due diligence and integration services and any other services that can clearly be designated as "non-audit" services, as defined by regulation.

21

The Audit Committee of the Board of Directors is responsible for independent, objective oversight of the Company's financial accounting and reporting, by overseeing the system of internal controls established by management and monitoring the participation of management and the independent auditors in the financial reporting process. The Audit Committee is comprised of independent directors, and acts under a written charter. Each of the members of the current Audit Committee is independent as defined under applicable SEC rules and AMEX listing standards.

The Audit Committee held five meetings during fiscal year 2003. The meetings were designed to facilitate and encourage private communication between the Audit Committee and the Company's independent accountants, the Deloitte Entities.

During the meetings, the Audit Committee reviewed and discussed the Company's financial statements with management and the Deloitte Entities. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The discussions with the Deloitte Entities also included the matters required by Statement on Auditing Standards ("SAS") No. 61 (Communication with Audit Committees), as amended by SAS 89 and 90 (Audit Committee Communications).

The Deloitte Entities provided to the Audit Committee the written disclosures and the letter regarding its independence as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and this information was discussed with The Deloitte Entities.

Based on the discussions with management and the Deloitte Entities, the Audit Committee's review of the representations of management and the report of the Deloitte Entities, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2003, filed with the Securities and Exchange Commission.

Submitted by the Audit Committee of the Company's Board of Directors

Paul J. Anderson Edwin C. Freeman Luella Gross Goldberg

THE PRECEDING REPORT SHALL NOT BE DEEMED INCORPORATED BY REFERENCE BY ANY GENERAL STATEMENT INCORPORATING BY REFERENCE THIS PROXY STATEMENT INTO ANY FILING UNDER THE SECURITIES ACT OF 1933 (THE "1933 ACT") OR THE SECURITIES EXCHANGE ACT OF 1934 (THE "1934 ACT"), EXCEPT TO THE EXTENT THE COMPANY SPECIFICALLY INCORPORATES THIS INFORMATION BY REFERENCE, AND SHALL NOT OTHERWISE BE DEEMED FILED UNDER THE 1933 ACT OR THE 1934 ACT.

22

Transactions and Shared Management with Hector Communications Corporation

The Company makes available to Hector Communications Corporation ("HCC"), which prior to 1990 was a subsidiary of the Company, certain staff services and administrative systems with the related costs and expenses being paid by HCC. In 2003 and 2002, HCC paid the Company $208,000 and $186,000, respectively, for such services, amounts that management believes are no less than the cost the Company incurred in connection with providing such services.

In fiscal 2003, two of the Company's executive officers, Curtis A. Sampson and Paul N. Hanson, each devoted 50% of their time to the Company. Messrs. Sampson and Hanson devoted substantially all of the remainder of their working time to HCC, for which Mr. Sampson serves as Chairman and Chief Executive Officer and Mr. Hanson serves as Vice President, Secretary, Treasurer and a director. These officers are separately compensated by HCC for their services to HCC.

Loans to Executive Officers

In October 1998, the Company's Board of Directors approved a loan to Jeffrey K. Berg, President and Chief Operating Officer, in the amount of $190,000 at an interest rate initially set at 6.5% per annum under a promissory note secured by real estate. On January 7, 2003, the balance due under this loan ($174,369) was repaid.

Contacting the Board of Directors

Any shareholder who desires to contact our Board of Directors may do so by writing to the Board of Directors, generally, or to an individual Director at: Communications Systems, Inc., 213 South Main Street, Hector, Minnesota 55342. Communications received electronically or in writing are distributed to the full Board of Directors, a committee or an individual Director, as appropriate, depending on the facts and circumstances outlined in the communication received. For example, a complaint regarding accounting, internal accounting controls or auditing matters will be forwarded to the Chair of the Audit Committee for review. Complaints and other communications may be submitted on a confidential or anonymous basis.

Shareholder Proposals for 2005 Annual Meeting

The proxy rules of the Securities and Exchange Commission permit shareholders of a company, after timely notice to the Company, to present proposals for shareholder action in the Company's proxy statement where such proposals are consistent with applicable law, pertain to matters appropriate for shareholder action and are not properly omitted by Company action in accordance with the Commission's proxy rules. The next annual meeting of the shareholders of Communications Systems, Inc. is expected to be held on or about May 19, 2005 and proxy materials in connection with that meeting are expected to be mailed on or about April 8, 2005. Shareholder proposals prepared in accordance with the Commission's proxy rules to be included in the Company's Proxy Statement must be received at the Company's corporate office, 213 South Main Street, Hector, Minnesota 55342, Attention: President, by December 15, 2004, in order to be considered for inclusion in the Board of

23

Directors' Proxy Statement and proxy card for the 2005 Annual Meeting of Shareholders. Any such proposals must be in writing and signed by the shareholder.

The Bylaws of the Company establish an advance notice procedure with regard to (i) certain business to be brought before an annual meeting of shareholders of the Company and (ii) the nomination by shareholders of candidates for election as directors.

Properly Brought Business. The Bylaws provide that at the annual meeting only such business may be conducted as is of a nature that is appropriate for consideration at an annual meeting and has been either specified in the notice of the meeting, otherwise properly brought before the meeting by or at the direction of the Board of Directors, or otherwise properly brought before the meeting by a shareholder who has given timely written notice to the Secretary of the Company of such shareholder's intention to bring such business before the meeting. To be timely, the notice must be given by such shareholder to the Secretary of the Company not less than 45 days nor more than 75 days prior to a meeting date corresponding to the previous year's annual meeting. Notice relating to the conduct of such business at an annual meeting must contain certain information as described in Section 2.9 of the Company's Bylaws, which are available for inspection by shareholders at the Company's principal executive offices pursuant to Section 302A.461, subd. 4 of the Minnesota Statutes. Nothing in the Bylaws precludes discussion by any shareholder of any business properly brought before the annual meeting in accordance with the Company's Bylaws.

Shareholder Nominations. The Bylaws provide that a notice of proposed shareholder nominations for the election of directors must be timely given in writing to the Secretary of the Company prior to the meeting at which directors are to be elected. To be timely, the notice must be given by such shareholder to the Secretary of the Company not less than 45 days nor more than 75 days prior to a meeting date corresponding to the previous year's annual meeting. The notice to the Company from a shareholder who intends to nominate a person at the meeting for election as a director must contain certain information as described in Section 3.7 of the Company's Bylaws, which are available for inspection by shareholders as described above. If the presiding officer of a meeting of shareholders determines that a person was not nominated in accordance with the foregoing procedure, such person will not be eligible for election as a director.

Other Matters; Annual Report

Management knows of no other matters that will be presented at the meeting. If any other matters arise at the meeting, it is intended that the shares represented by the proxies in the accompanying form will be voted in accordance with the judgment of the persons named in the proxy.

The Company is transmitting with this Proxy Statement its Annual Report for the year ended December 31, 2003. Shareholders may receive, without charge, a copy of the Company's 2003 Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, by writing to Secretary, Communications Systems, Inc., 213 South Main Street, Hector, Minnesota 55342.

| By Order of the Board of Directors, | ||

Paul N. Hanson, Secretary |

24

CHARTER OF THE AUDIT COMMITTEE OF

COMMUNICATIONS SYSTEMS, iNC.

Composition

The Audit Committee of the Board of Directors of Communications Systems, Inc. ("Company") shall consist of a minimum of three directors. The members of the Committee and the Chair of the Committee shall be appointed by the Board of Directors. Any member of the Committee may be removed by the Board of Directors in its discretion. All members of the Committee shall be independent directors of the Company under the listing standards proposed by the American Stock Exchange, and shall also satisfy the American Stock Exchange's more rigorous independence requirement for members of an audit committee.

All members of the Audit Committee shall be able to read and understand fundamental financial statements, including the Company's balance sheet, income statement and cash flow statement. Additionally, at least one member of the Audit Committee shall be financially sophisticated as a result of past employment experience in finance or accounting, requisite professional certification, accounting or any other comparable experience or background, including, but not limited to being or having been a chief executive officer, chief financial officer, other senior officer with financial oversight responsibility or an active participant on one or more public company audit Committees.

Purpose

The purpose of the Audit Committee shall be to oversee the accounting and financial reporting processes of the issuer and the audits of the financial statements of the issuer, including oversight of:

Authority and Responsibility

A. The Committee shall have the sole authority and responsibility to select, oversee, evaluate and, if necessary, replace the independent auditor and the independent auditor shall be solely accountable to the Audit Committee. The Committee shall have the sole authority to approve all audit engagement fees and terms and the Committee, or the Chair of the Committee, must pre-approve any non-audit service provided to the Company by the independent auditor. The Committee shall have the sole authority and responsibility to resolve disagreements between management and the independent auditor regarding financial reporting.

B. The Audit Committee shall have the authority and responsibility:

1. To discuss with management and the independent auditor annual audited financial statements and quarterly financial statements, including matters required to be reviewed under applicable legal, regulatory or American Stock Exchange requirements, and to recommend the

A-1

annual audited financial statements to be included in the Company's Annual Report on Form 10-K.

2. To discuss with management and the independent auditor, as appropriate, earnings press releases and financial information and earnings guidance provided to analysts and to rating agencies.

3. To discuss with management and the independent auditor, as appropriate, any audit problems or difficulties and management's response, and the Company's risk assessment and risk management policies, including the company's major financial risk exposure and steps taken by management to monitor and mitigate such exposure.

4. To review the Company's financial reporting and accounting standards and principles, critical accounting policies and practices, significant changes in such standards, principles or practices or in their application and the key accounting decisions affecting the Company's financial statements, including alternatives to, and the rationale for, the decisions made.

5. To review the Company's internal system of audit and financial controls, and the results of internal audits.

6. To review significant litigation and regulatory proceedings in which the Company is or may be involved for analysis of potential impact on the Company's financial statements, including receiving reports from the Company's legal counsel regarding any dispute, litigation, regulatory matter or proceeding or any material violation of securities laws or breach of fiduciary duty or similar violation by the Company or any agent of the Company.

7. To prepare and publish a report of the Committee to shareholders in the Company's annual proxy statement.

8. To obtain and review at least annually a formal written report from the independent auditor delineating: the auditing firm's internal quality-control procedures; any material issues raised within the preceding five years by the auditing firm's internal quality-control reviews, by peer reviews of the firm, or by any governmental or other inquiry or investigation relating to any audit conducted by the firm.

C. The Committee shall have authority and responsibility for (i) insuring its receipt from outside auditors of a formal written statement delineating all relationships between the auditor and the Company, consistent with the standards of the Independent Standards Board, as well as responsibility for evaluating whether any such disclosed relationships or services provided by the auditor affect the objectivity and independence of the auditor and (ii) taking appropriate action to oversee the independence of the outside auditor.

D. The Audit Committee shall establish procedures for (i) receipt, retention and treatment of complaints received by the Company with respect to accounting, internal auditing controls or auditing matters, and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

E. The Audit Committee shall have authority to retain such outside legal counsel, experts and other advisors as the Committee may, in its sole discretion, deem appropriate to fulfill its responsibilities under this charter, the listing standards of the American Stock Exchange and SEC

A-2

Rule 10A 3(b) (2), (3), (4) and (5) under the Securities Exchange Act of 1934, as amended. The Committee shall have sole authority to approve fees incurred under this Paragraph E and related contracts with such legal counsel, experts and other advisors and the Company shall pay all such fees and expenses as determined appropriate and necessary by the Audit Committee in carrying out its duties.

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the committee to conduct audits or to determine that the Company's financial statements are complete and accurate and are in accordance with generally accepted accounting principles, which is the responsibility of management and the independent auditors. It is also the responsibility of management to assure compliance with laws and regulations and the Company's corporate policies, with oversight by the Committee in the areas covered by this Charter.

Key Practices

The Committee shall meet separately at least four (4) times each year with management and the Company's independent auditors. With respect to any meeting, a majority of the Committee shall constitute a quorum for conducting business.

The Committee shall provide minutes of Committee meetings for the full Board and shall, as appropriate, report at meetings of the Board regarding Committee activities and decisions.

The Committee shall review at least annually the adequacy of this charter and recommend any proposed changes to the Board for approval.

The Committee shall adopt (and periodically review and revise, as appropriate) a statement of other key practices it shall follow in discharging its duties under this Charter.

A-3

COMMUNICATIONS SYSTEMS, INC.

ANNUAL MEETING OF SHAREHOLDERS

May 20, 2004

3:00 p.m. Central Daylight Time

Communications Systems, Inc.

6475 City West Parkway

Eden Prairie, Minnesota

| COMMUNICATIONS SYSTEMS, INC. | proxy | |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 20, 2004

The undersigned hereby appoints, Edwin C. Freeman, Luella Gross Goldberg and Wayne E. Sampson or any of them, as proxies, with full power of substitution to vote all the shares of common stock which the undersigned would be entitled to vote if personally present at the Annual Meeting of Shareholders of Communications Systems, Inc., to be held May 20, 2004, at 3:00 p.m. Central Daylight Time at the offices of Communications Systems, Inc., 6475 City West Parkway, Eden Prairie, Minnesota, or at any adjournment thereof, upon any and all matters which may properly be brought before the meeting or adjournment thereof, hereby revoking all former proxies.

See reverse for voting instructions.

\*/ Please detach here \*/

| 1. | ELECTION OF DIRECTORS: | 01 Gerald D. Pint 02 Curtis A. Sampson |

o | Vote FOR all nominees (except as marked) |

o | Vote WITHHELD from all nominees |

||||||||

(Instructions: To withhold authority to vote for any indicated nominee, write the number(s) of the nominee(s) in the box provided to the right.) |

||||||||||||||

| 2. | Proposal to approve an amendment to the Company's Stock Plan. | o For o Against o Abstain | ||||||||||||

3. |

THE PROXIES ARE AUTHORIZED TO VOTE IN THEIR DISCRETION UPON ANY OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING. |

|||||||||||||